Experience error-free, automated payouts that ensure accuracy and eliminate delays in vendor payments.

Simplify payment workflows with streamlined processes, saving time and reducing operational complexities effortlessly.

Timely and secure payments foster trust and strengthen partnerships, ensuring lasting business relationships.

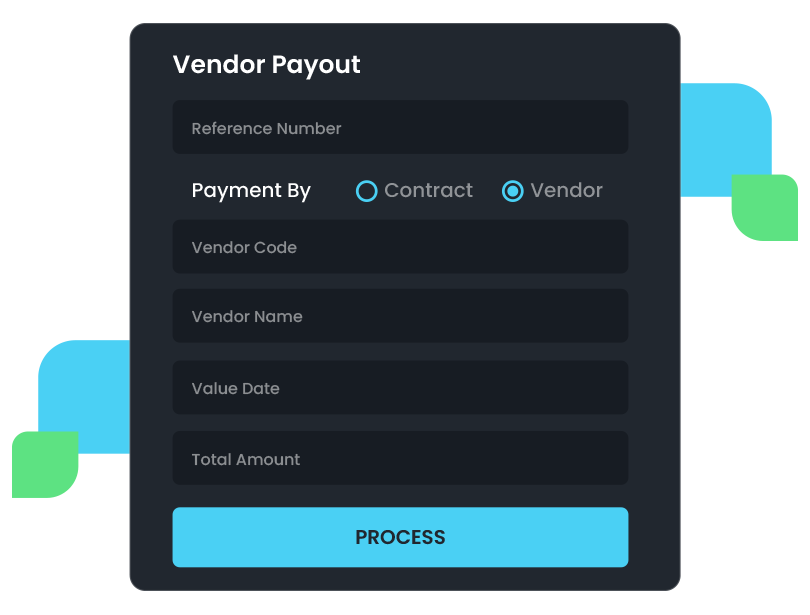

Easily trigger vendor payouts through automated systems, ensuring accuracy and efficiency every time.

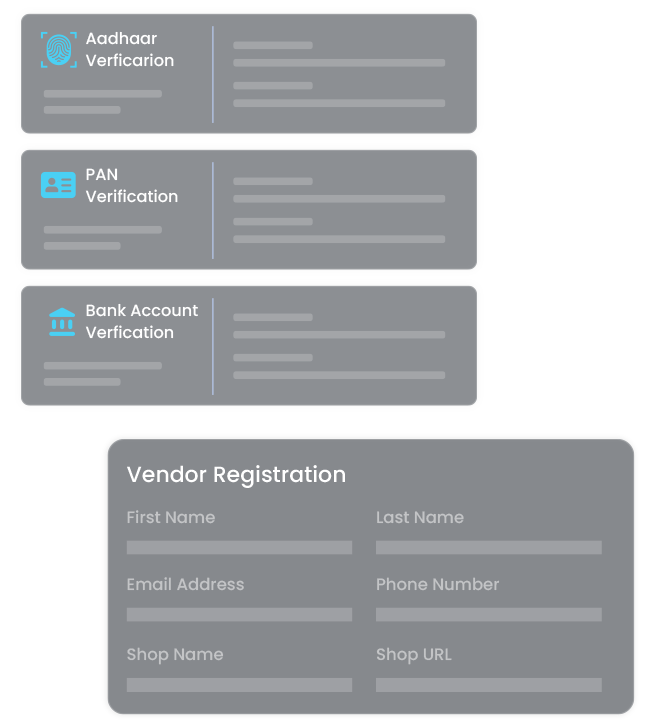

Verify vendor details and payment data seamlessly to eliminate errors and ensure compliance.

Handle bulk payments with secure processing, ensuring timely and accurate disbursements to vendors.

Access detailed reports for easy tracking, helping maintain financial transparency and vendor satisfaction.

“Data encryption ensures that all sensitive vendor payment information, including bank details and transaction records, is securely encoded during transmission. This protects against unauthorized access and data breaches, providing a secure environment for both businesses and their vendors, ensuring complete confidentiality in every transaction. ”

“Our advanced fraud detection system uses machine learning and real-time analytics to monitor transactions and identify suspicious activity. By analyzing patterns and flagging anomalies, we help prevent fraudulent payments, ensuring that vendors receive secure, verified payments while safeguarding your business from potential risks.”

“With multi-factor authentication (MFA) and role-based access control, our platform ensures that only authorized personnel can initiate, approve, or access payment data. This guarantees that all payment operations are conducted by verified individuals, reducing the risk of unauthorized transactions and protecting sensitive vendor data. ”

“Our proactive risk management protocols continuously assess and mitigate potential threats in the payment process. By using real-time monitoring and predictive analytics, we identify risks early, enabling businesses to take preventive actions, ensuring secure vendor payments, and minimizing exposure to fraud or errors.”

Ensure all vendor payments meet industry standards and comply with local and National regulations.

Maintain detailed logs of payment transactions, ensuring transparency and accountability for all activities.

Track compliance status in real-time with automated alerts for any regulatory changes or discrepancies.

Evaluate potential risks in vendor payments to proactively address compliance and security concerns.

Validate payment data for accuracy and completeness to ensure adherence to compliance requirements.

Generate easy-to-understand compliance reports that provide clarity and accountability for all transactions.